Invoices for your freelance writing business are like the lug nuts on your car’s tires.

They’re not glamorous, and they don’t get a lot of attention, but without them, you won’t get very far.

But for new freelancers, invoices can be something of a mystery.

When should you send them? What format should they be in? How soon should they be paid?

Truthfully, there’s no right or wrong answer for these questions. You could ask ten different freelancers, and each one might give you a different take.

The other big variable in invoicing is the tools you use to generate them. It can be overwhelming for a new freelancer to learn about invoicing, and even experienced writers may be confused about picking the right invoicing tool for their needs.

Further complicating the matter, there are dozens of applications designed to make invoicing easier; accounting and billing are one of the most popular categories of cloud software.

To make the process easier, let’s go over some of the basic tenets of invoicing as a freelance writer, then compare six different tools you can use to generate invoices.

All About Invoicing

An invoice is simply a formal document stating that money is owed to the invoicing party (you) from the recipient (your client). You’ve probably received invoices from businesses you’ve used as a consumer, especially professional service providers: Plumbers, attorneys, landscapers, etc.

Invoices matter because most clients expect their vendors (that’s you!) to send them an invoice that provides an official record of things like:

-

- The amount of work completed

-

- The cost of that work

-

- The vendor’s contact information

- Any specific payment terms

On most projects, there is an accounting department which handles payments and is separate from the part of the business that the person who hired you works in. Without an invoice, accounting has no way of knowing that their colleague in the marketing, editorial, or communications department has hired a freelance writer as a contractor.

All this to say:

If you don’t send an invoice, you won’t get paid!

What should you put on an invoice?

If you want to make invoices as easy as possible, here’s a simple trick:

Ask the client how they prefer invoices, and do that.

Especially if your client is a larger company, their accounting department probably has a preferred format. Ask for a template and/or invoicing instructions and follow those guidelines.

Of course, it’s not always that easy.

If the client defers to you or says they are flexible about invoices, you have a little more work to do. But don’t worry – creating an invoice is still pretty easy.

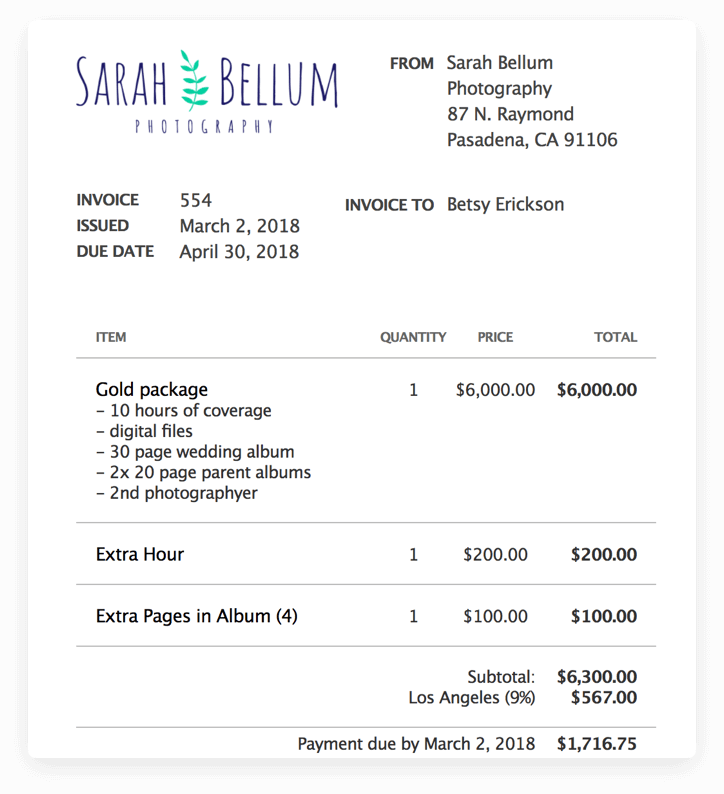

Aside from the elements mentioned above that describe the work done for the client and its cost, a complete invoice should include:

- Your name and contact info. If you write using a business name, use that instead. Remember to include your phone number and email address – the accounting department handling your invoice may not have that info.

- The client’s name and contact info. Put the name of the specific person you’re working with, in case the accounting department has a question about the work you did and doesn’t know who to contact. This is different from the next field.

- An ATTN: field. This line is short for “attention.” It indicates that someone in the accounting department needs to handle it. Ask your contact at the client who you should mention in this field. If they don’t respond, it’s okay to leave this off, but mention it when you send the invoice.

- Invoice number. Unless the client has a specific format they want – and they’ll tell you if they do – you can simply make up your own. Use a mix of letters and numbers to keep the system unique, especially if you’ll be doing recurring work – they’ll learn to recognize your invoice by the numbering system you use.

This list is far from definitive; again, your best bet is to ask the client their preferences and follow what they say. They should at least be able to give you a blank or old invoice from another vendor so you can see which format to use.

A quick Google search will find dozens of free invoice templates for you to take inspiration from. HubSpot also offers a completely free invoice generator that can get you started.

But if you’re looking for a more comprehensive solution that can generate invoices without as much legwork, or an all-in-one suite that includes accounting and invoice functionality, there are some excellent software options.

We took a look at five of the most popular methods for freelancers to generate invoices. Here’s a quick description of each one, along with their respective pros and cons.

Freelance Writer Invoicing Tool Roundup

PayPal

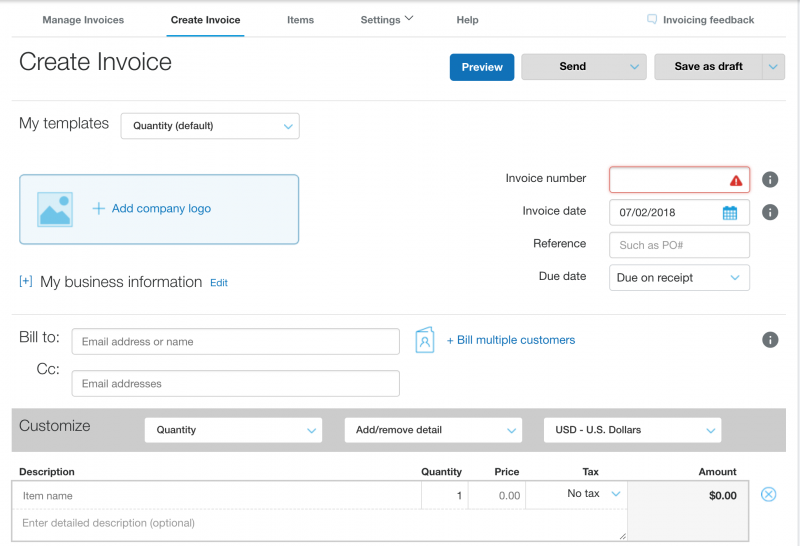

With over 14 million merchants and nearly 185 million customers around the world, PayPal is one of the biggest payment processing companies around. They also have a very easy-to-use invoicing feature that is easy to edit, save drafts, and preview.

Pros:

- Free & widely used. Many of your clients will already be using PayPal, and it’s easy to set up a merchant account.

- Simple interface that you can learn to use in just a few minutes.

- Reports and reminders can be generated with just a few clicks.

Cons

- High fees. PayPal takes 2.9% plus $0.30 per transaction. It may not seem like a lot, but when your invoices get into the high three- and four-figure range, you’ll start to notice.

- Only generates invoices in PayPal. You still have to download and manually send a PDF copy.

17hats

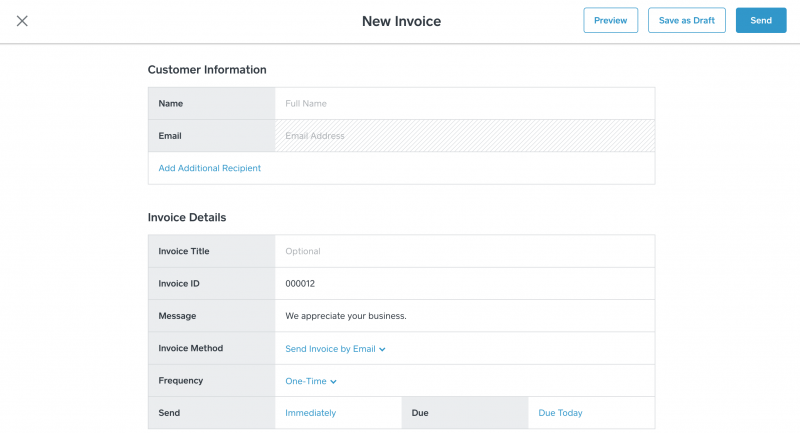

17hats is a cloud-based invoicing service that has received millions of dollars in venture funding, for good reason: It provides a comprehensive platform for freelancers and solopreneurs to automate many different business processes, from following up with leads to generating profit reports (and invoicing, of course).

17hats is a cloud-based invoicing service that has received millions of dollars in venture funding, for good reason: It provides a comprehensive platform for freelancers and solopreneurs to automate many different business processes, from following up with leads to generating profit reports (and invoicing, of course).

Pros

- Handles everything – it’s a one-stop-shop for productivity, accounting, and sales tools.

- Easy, intuitive layout that uses simple buttons and clear visuals.

- Plenty of support with live chat, guides, tutorials, and a Facebook group.

Cons

- Cost. There’s a free trial, but the entry-level plan will run you $37 per month.

- Complexity. If you just want a simple solution for invoicing and nothing else, 17hats isn’t the right choice.

FreshBooks

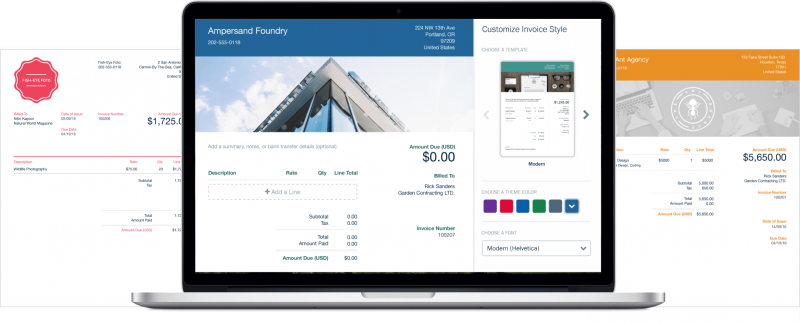

One of the oldest companies in the industry, FreshBooks boasts over 10 million customers and $60 billion in invoice payments through its network. Like 17hats, it offers a full set of tools for the modern freelancer or small business owner, including time and expense tracking, project management, and payment processing.

Pros

- Trusted name in the industry, operating since the mid-2000s.

- Robust reporting, mobile, and automation capabilities.

Cons

- Cost, though it’s reasonable – $15 per month, less with annual billing.

- Tons of features that you may not need or want.

Square

Co-founded by Silicon Valley legend Jack Dorsey in 2009, Square started off as a mobile payment processor but soon evolved. Its emphasis is still on payment processing, but Square now includes features like invoicing and marketing campaigns.

Pros

- No account fees. Square charges a commission of 2.75% to 3.5% depending on whether a transaction is in-person, online, or keyed in.

- Simple and easy credit card processing, a popular payment method for writing clients.

Cons

- Limited invoice functionality. Like PayPal invoices are created and sent only on the Square network.

- Mobile-first nature means the app is easier to use on a smartphone or tablet.

Microsoft Word

It’s not designed specifically for invoicing, but you can make solid invoices by saving a document as a PDF file in Word or a similar alternative. Pro tip: Spend some time designing a blank invoice format, then save it as a template to reuse.

Pros

- Accessible. You probably already have it or another word processor on your computer.

- Simple yet powerful. You control every detail of the invoice, from colors to font size.

Cons

- Time-consuming if you’re designing an invoice from scratch.

A Final Note on Invoicing

Whichever way you decide to go, remember one thing:

Don’t make it complicated.

You’re a writer, not a professional invoice maker.

Minimize the amount of time and complexity invoicing takes by choosing one method and committing to it so that you can focus on the activities that will earn you more in your business.